Transparency in Coverage Raw Data Files Can Ensure Employer Health Plans Are Paying Fair Prices

5/25/23

Self-insured employers have a new tool to ensure they are paying fair prices for medical services. The Consolidated Appropriations Act, 2021 (CAA) established protections for consumers related to surprise billing and transparency in health care. It created a unique opportunity by establishing the Transparency in Coverage (TiC) requirements, making available all negotiated prices from every healthcare payer to every medical provider for every service in the U.S., beginning in the latter half of 2022, updated monthly. These rules provided unprecedented access to proprietary price information. The resulting data can transform how payers and providers negotiate, and it can result in the elimination of unwarranted price variability. However, the datasets are massive and messy, and the value is contingent upon making the data interpretable and actionable. Accessing this data requires transparent data sourcing, selection, cleaning, & quality control, with considerable experience in working with large healthcare data.

According to Phil Denniston, President of DDI, “We believe increased transparency, in both costs and quality, is the key to improving outcomes in the U.S. Healthcare System. This will benefit both payers and providers, and most importantly, patients.”

Hospital Price Transparency files were mandated for release under the CAA a year earlier than the Transparency in Coverage (TiC) payer files, but the hospital files suffered from a lack of compliance due to minimal penalties. As a result, the penalties for noncompliance with the TiC payer file requirements were set very high, and compliance with TiC has been excellent. In addition, all of the hospital negotiated prices are already covered in the TiC files, along with negotiated prices for every type of provider, so the hospital files are unnecessary. And the TiC file requirements mandated a data consistency that was lacking in the hospital price files. The CAA also included the No Surprises Act (NSA), which provided a new basis for out-of-network price negotiation, which source data is also included in the Transparency in Coverage (TiC) Raw Data Files.

Plus, under CAA, self-insured employers have increasing fiduciary responsibility to their employees to ensure their healthcare prices are fair and reasonable. Fiduciaries need to consider how the CAA’s ‘covered service provider’ compensation disclosures could inform generally applicable ERISA principles tied to ensuring those vendors are paid reasonable compensation. This responsibility also applies to how health plans or TPAs bargain for their employer clients.

Benchmark prices are now available in user-friendly tools for public use from all official US Government mandated TiC data. Not only do these tools provide price transparency, but they also use a transparent process, unlike past healthcare pricing services, which may have been based on guesstimates or confidential sources. These tools can be used for negotiating a “Fair Price.” They cover all reimbursement codes, easily searchable: DRG (hospitals), HCPCS (doctors & other providers, including CPT & CDT), ICD codes, & RC (revenue codes), based on tens of billions of U.S. negotiated prices, after thorough quality control checking, using over 50,000 health plan non-duplicate files.

With this data, employers or their agents can access what used to be highly confidential, undisclosed information, at their fingertips. And employers can achieve compliance with the CAA (Consolidated Appropriations Act) and the NSA (No Surprises Act). CAA will make fiduciaries of self-insured employers for healthcare services they purchase.

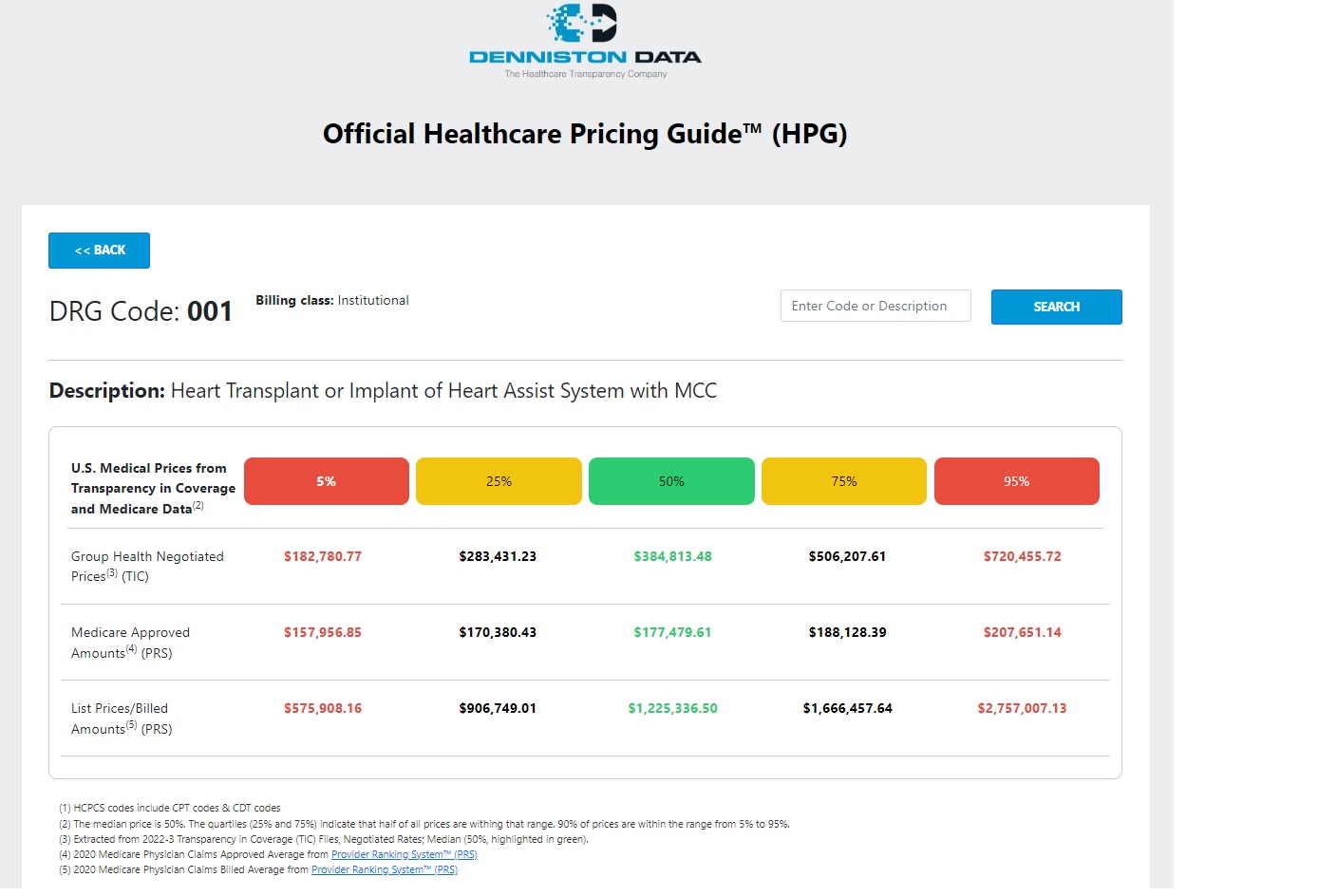

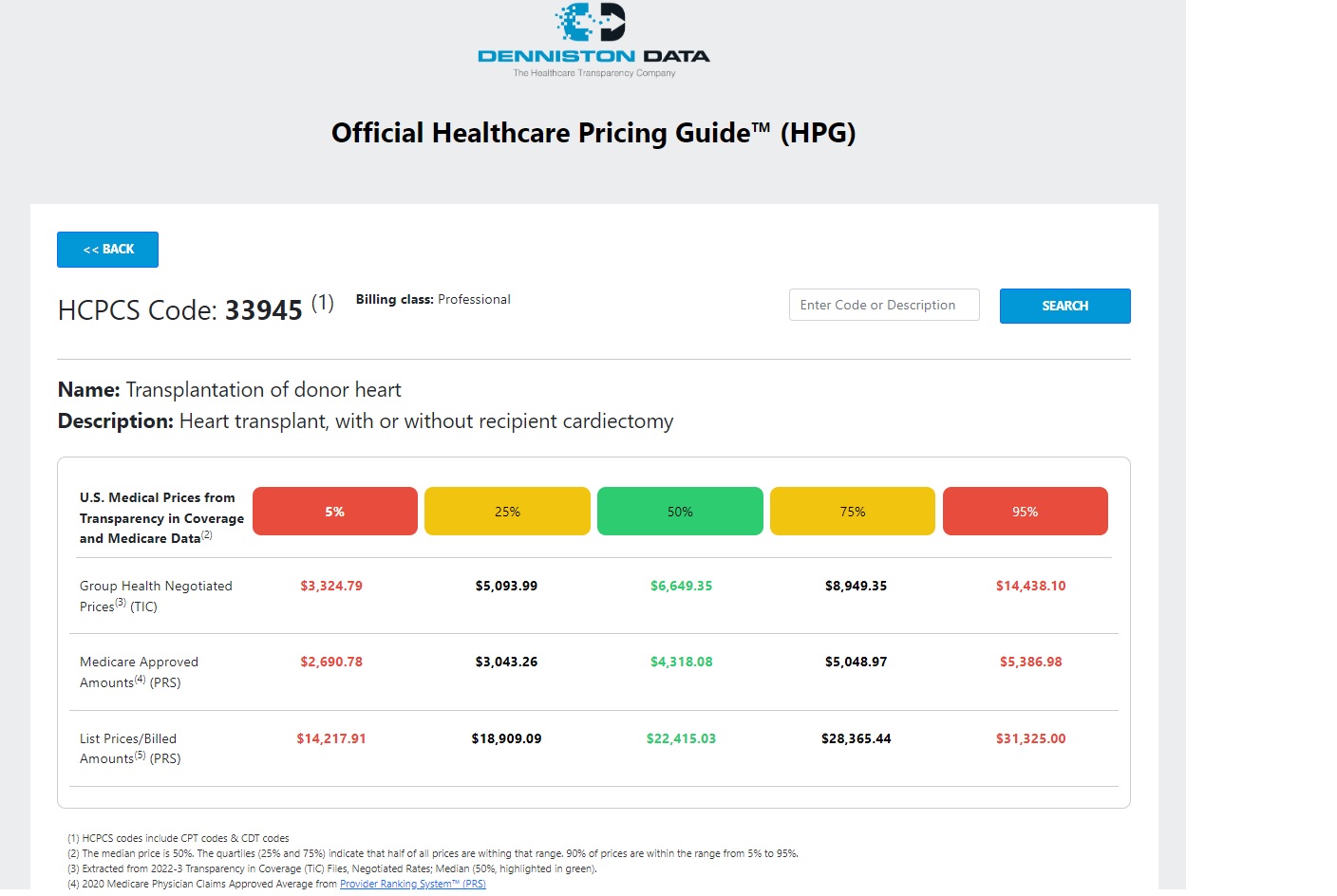

In a recent study, one tool, the Official Healthcare Pricing Guide™ (HPG), was applied for a test case client, a typical mid-sized self-funded employer, and it was shown to result in a return on investment of one thousand to one. By spending $1,000 on HPG, the client saved $1 million per year in healthcare costs. The secret was to target services where they were substantially overpaying in contract negotiated rates relative to TiC benchmark rates. These services represented about 20% of total costs, where the client was overpaying by an average of 50% or more. After renegotiations, overpayments were cut by half on average. Citing the TiC “Fair Price” was key in the renegotiations. These negotiations may be by benefits consultants or TPAs on behalf of the employer, and it was important not to renegotiate services where they were currently paying at or below TiC benchmark. For this typical employer with about 2,000 employees, the cost to access the data was $1,000, and the annual savings was $1 million. For other employers currently overpaying on over 20% of services, savings may be much higher. For all employers, they would have fulfilled their fiduciary responsibility under CAA to ensure they are not paying excessive rates. Below are example screenshots of what the benchmark data looks like, for a hospital charge using DRG, and for a physician payment using HCPCS/CPT:

What does this mean for self-insured employers? The CAA transparency data release is one of the major breakthroughs of our time with respect to reducing U.S. healthcare costs. It has resulted in the development of a new standard in pricing. This new standard is available without having to resort to government price controls, as some have suggested, and the new pricing is not based on Medicare or the related Reference Based Pricing (RBP), which have their perceived disadvantages. This is a “Fair & Reasonable Price,” based on actual prices. According to the Boston Consulting Group, the legal definition of a fair price is, “a price others pay for a good or service.” Having this data allows “Evidence-Based” provider negotiations.

The target for fair price from the TiC data is median price, or 50%. Quartiles (25% and 75%) indicate that half of all prices are within that range, and 90% of prices are within the range from 5% to 95%; any price outside of that is an outlier. Reports can also show Medicare approved amounts, for comparison, from Provider Ranking System™ (PRS), and list prices/billed amounts, also from PRS. Further options are available to retrieve individual negotiated prices by provider and/or by health plan. After eliminating codes with under 100 cases, there are a total of 33,259 separate entries (not including NDC Codes), with the following distribution by reimbursement code:

Group Health Negotiated Prices (from TiC) | ||

| HCPCS Professional | 14,910 |

| HCPCS Institutional | 9,563 |

| DRG Institutional | 765 |

| ICD Institutional | 512 |

| RC Institutional | 91 |

Medicare Approved Amounts (from PRS) | ||

| HCPCS Professional | 3,709 |

List Prices/Billed Amounts (from PRS) | ||

| HCPCS Professional | 3,709 |

In 2023, we now finally have a breakthrough opportunity to fix U.S. healthcare, thanks to the passage of the Consolidated Appropriations Act, 2021 (CAA).

Disclaimer: The information contained in this article is provided for informational purposes only, and should not be construed as legal advice on any subject matter.